Mahilamitra Customer Application – Muthoot Microfin Limited

Empowering Underserved Women Through Financial Inclusion: The Mahilamitra Initiative by Muthoot Microfin Limited

Problem

- Educating and upgrading the financial discipline of clients, particularly women in underserved areas.

- Transitioning to paperless processes to address environmental concerns.

- Enhancing the security and confidentiality of the loan application process.

- Overcoming language barriers by integrating vernacular support.

- Providing faster services and assistance through digital platforms.

Solution

- Utilizing a robust change management system for prioritizing and approving features.

- Implementing coding and testing processes in structured sprint cycles.

- Conducting regression and quality assurance testing to ensure system reliability.

- Launching the Mahilamitra app with multilingual support and user-friendly design.

- Continuously improving the app based on user feedback and monitoring.

Outcomes

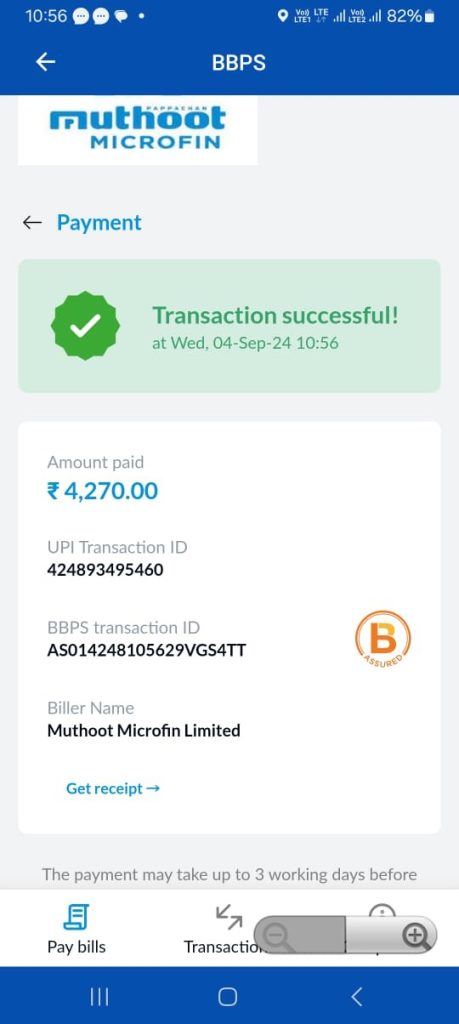

- Collected repayments exceeding INR 2 crore through online gateways.

- Achieved a 4.2-star rating on the Google Play Store for better user experience.

- Engaged 1,728,964 women through the Mahilamitra app.

- Transitioned to paperless transactions, supporting environmental sustainability goals.

- Improved customer experience with seamless integration of financial tools.

Challenges

- Educating tech-averse clients and overcoming time constraints in awareness programs.

- Addressing the low penetration of smartphones in rural households.

- Coordinating the integration of multiple payment gateways.

- Conducting exclusive training sessions for the digitized loan application process.

- Overcoming cultural and technological trust barriers in financial services.

Innovations

- Designing the Mahilamitra app tailored specifically for women in underserved communities.

- Incorporating multilingual and user-friendly financial literacy modules.

- Offering flexible repayment terms and minimal documentation for financial inclusion.

- Integrating customized insurance products (health, life, crop) into the platform.

- Establishing a community-centric approach with peer-to-peer networking features

SKOCH Award Nominee

Category: Corporate Excellence

Sub-Category:Customer Satisfaction and Loyalty

Project: Mahilamitra Customer Application

Start Date: 3-16-2020

Organisation: Muthoot Microfin Limited

Respondent: Santhosh Kumar

https://muthootmicrofin.com/

Level: BFSI – 4

Video

See Presentation

Gallery

Case Study

Empowering Underserved Women Through Financial Inclusion: The Mahilamitra Initiative by Muthoot Microfin Limited

Introduction

Muthoot Microfin Limited’s Mahilamitra Customer Application stands as a transformative digital solution designed to address the unique challenges faced by women in underserved communities across India. By bridging the gap in financial inclusion, the Mahilamitra app empowers women with the tools and knowledge to manage their finances effectively. This case study delves into the problems, solutions, outcomes, challenges, and innovations of this impactful initiative.

Problems Addressed

Muthoot Microfin identified several critical issues affecting women’s access to financial services in India, including:

- Limited Financial Literacy: A significant portion of the target audience lacked financial awareness and basic budgeting skills.

- Environmental Concerns: Traditional paper-based processes were resource-intensive and environmentally unsustainable.

- Insecure Loan Processes: Women often faced challenges related to the security and confidentiality of financial transactions.

- Language Barriers: A diverse linguistic landscape hindered the accessibility of financial services for women from various regions.

- Slow and Cumbersome Services: Inefficiencies in existing systems delayed service delivery, impacting user satisfaction.

Solutions Implemented

To tackle these challenges, Muthoot Microfin developed and implemented the Mahilamitra app with the following key features:

- Comprehensive Change Management System: A structured approach ensured that feature requests from operations, credit, and other departments were prioritized and executed efficiently.

- Streamlined Digital Processes: Coding, testing, and quality assurance protocols were executed in multi-week sprint cycles, ensuring the app’s reliability.

- Multilingual Support: The app provided vernacular language options to cater to users from diverse linguistic backgrounds.

- Paperless Transactions: Transitioning to digital processes significantly reduced the environmental footprint of financial operations.

- User-Centric Design: Features like chatbots and voice-enabled assistance enhanced usability and ensured seamless navigation for less tech-savvy users.

Key Outcomes

The Mahilamitra initiative achieved remarkable success, as evidenced by its tangible outcomes:

- Increased Financial Inclusion: Over 1,728,964 women in underserved areas downloaded the app, accessing crucial financial services.

- Sustainability Goals: The transition to paperless processes aligned with environmental conservation efforts.

- Enhanced User Experience: A 4.2-star rating on the Google Play Store reflected the app’s user-friendly design and efficient service delivery.

- Digital Repayments: The app facilitated online repayments exceeding INR 2 crore, demonstrating its effectiveness in promoting digital financial transactions.

- Community Engagement: The app’s community-centric approach fostered peer-to-peer networking, enabling women to share experiences and resources.

Challenges Faced

The journey to implement the Mahilamitra app was not without hurdles:

- Digital Awareness: Educating users who were unfamiliar with technology required significant time and effort.

- Smartphone Penetration: Limited ownership of smartphones in rural households posed an initial barrier to adoption.

- Integration Complexities: Coordinating the incorporation of multiple payment gateways required extensive collaboration and technical expertise.

- Training Needs: Conducting exclusive sessions to teach users the digitalized loan application process was resource-intensive.

- Trust Barriers: Building confidence in digital financial services among a skeptical user base was a continuous challenge.

Innovations

Muthoot Microfin’s Mahilamitra app introduced several innovative features that set it apart as a transformative tool for financial inclusion:

- Tailored Financial Literacy Modules: The app offered educational content ranging from basic budgeting to advanced investment strategies, ensuring accessibility for women with varying levels of financial awareness.

- Flexible Financial Solutions: Services were designed to accommodate users without formal credit histories, with minimal documentation and customizable repayment terms.

- Custom Insurance Products: Affordable and tailored health, life, and crop insurance options provided a safety net against unforeseen financial shocks.

- Security and Privacy: Advanced data protection measures instilled confidence among users regarding the safety of their transactions.

- Community-Centric Networking: Peer-to-peer networking features allowed women to connect, share insights, and foster a sense of community.

Implementation Process

The development and deployment of the Mahilamitra app followed a meticulous process:

- Feature Development: Customer-facing departments submitted change requests, which were prioritized and developed in sprints.

- Testing and Quality Assurance: Features were tested extensively through regression testing and quality assurance protocols.

- User Acceptance Testing (UAT): A test application was shared with end users for feedback, ensuring the app met their needs.

- Deployment and Monitoring: Post-launch, the app was made available on the Google Play Store, with continuous monitoring to collect feedback and implement improvements.

- Continuous Improvement: The development team engaged in an iterative process to enhance the app’s features and user experience based on real-world usage and feedback.

Lessons Learned

The Mahilamitra initiative highlighted several valuable lessons:

- Adaptability: Addressing cultural and linguistic diversity requires flexible and inclusive design.

- User Education: Building digital awareness and trust is critical for the adoption of financial technology in underserved communities.

- Sustainability Integration: Paperless operations not only reduce costs but also align with environmental goals.

- Community Focus: Empowering users through peer networks fosters long-term engagement and trust.

- Iterative Development: Continuous feedback loops are essential to refine and improve digital solutions.

Conclusion

The Mahilamitra app by Muthoot Microfin Limited exemplifies how technology can be leveraged to address systemic barriers to financial inclusion. By empowering over 1.7 million women, the initiative has created a ripple effect of economic empowerment, fostering independence and resilience in underserved communities. Through its innovative approach and commitment to user-centric design, Mahilamitra is not just an app; it is a movement toward a more inclusive and equitable financial ecosystem.

For more information, please contact:

Santhosh Kumar at santhosh.k@muthootmicrofin.com

(The content on the page is provided by the Exhibitor)