Technology – Strategic Transformation – Central Bank of India

The best way to show your appreciation for this project is to click some advertisements and keep a count of how many you clicked. You will be asked for the number of advertisements that you clicked before you can vote. The money generated through this supports our social action.

Performance Management System for Banks

Problem

- Branch officers were judged on overall branch performance, and there were negligible measurable KRAs for administrative officers and no roles defined for clerical staff.

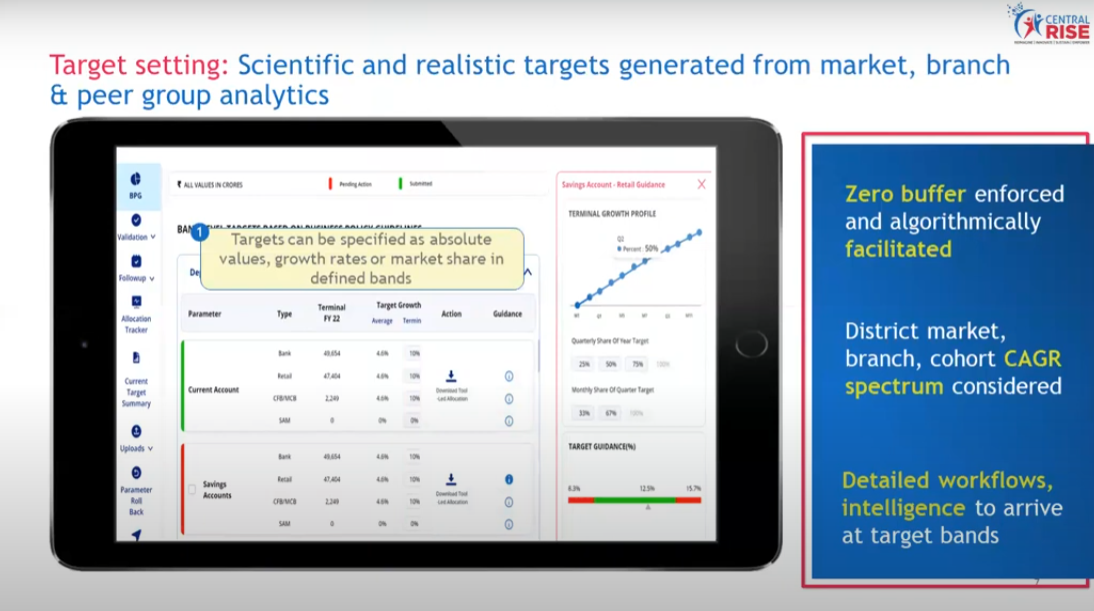

- Targets were set only on terminals and the previous year’s YoY growth, and only a quantitative factor was there, with no linkage with catchment-area potential.

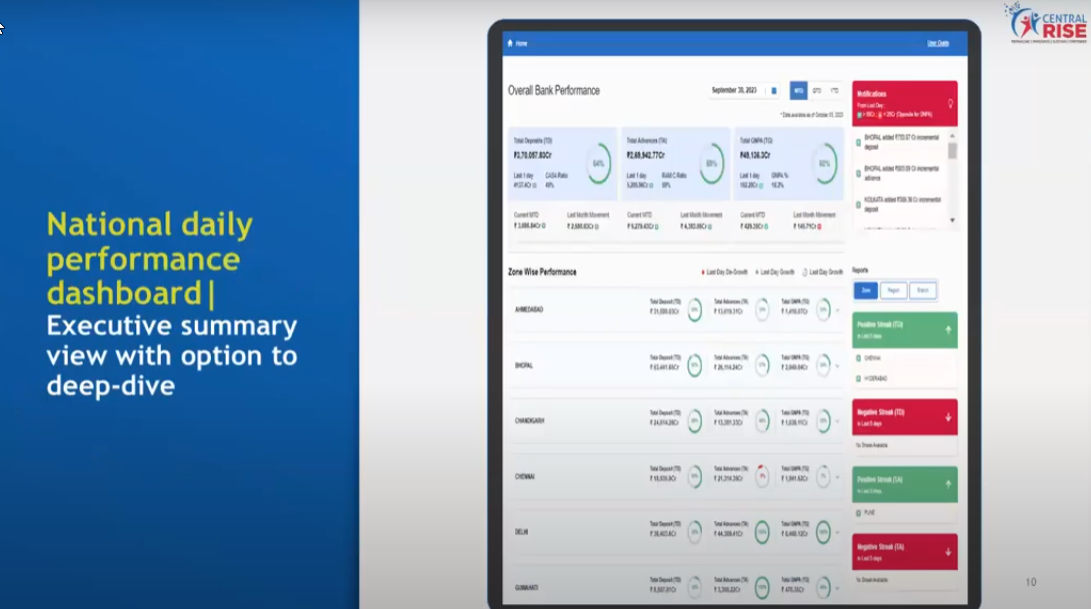

- There was backwards look with a prior focus on the post-mortem of the performance of the previous month instead of daily discussions.

- No differentiation in employee scores and poor linkage to actual performance with high-grade inflation and clearly visible goal attempts

- The workforce was based on the branch size instead of footfall or transactions with a high workload in rural branches and a low workload in metro branches).

Solution

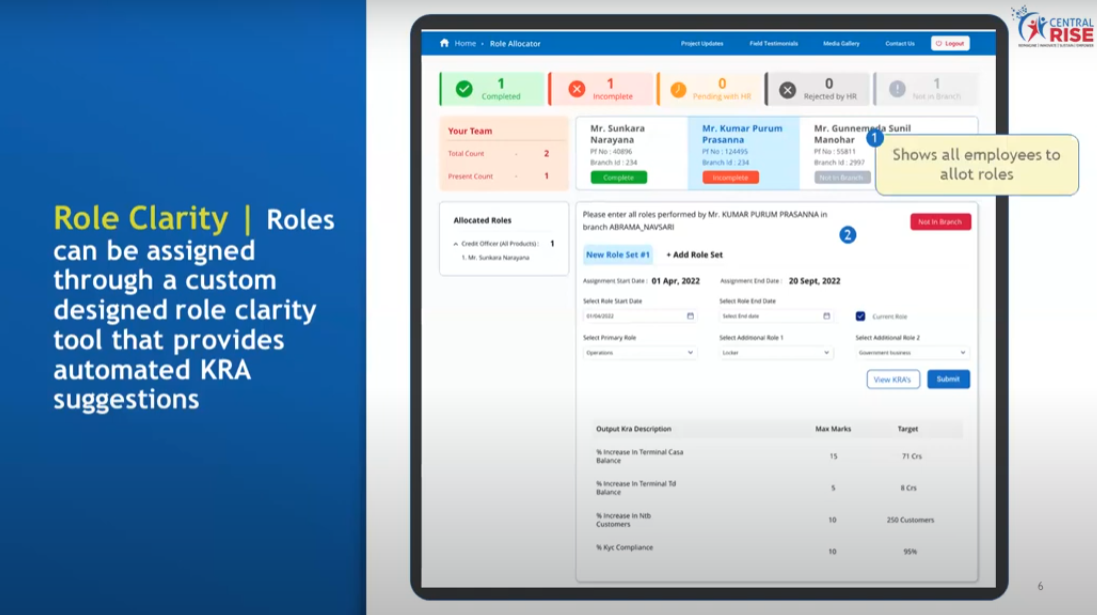

- Developed an intuitive digital tool to ensure that the right person gets the right role and KRAs, which are auto-allocated based on the role combinations selected.

- Digital workflow facilitating zero buffers, auto cascading and auto rebalancing of targets.

- Product level Targets are based on granular pin code level data to incorporate local / micro-market specifics and include market share and internal benchmarking (cohorts).

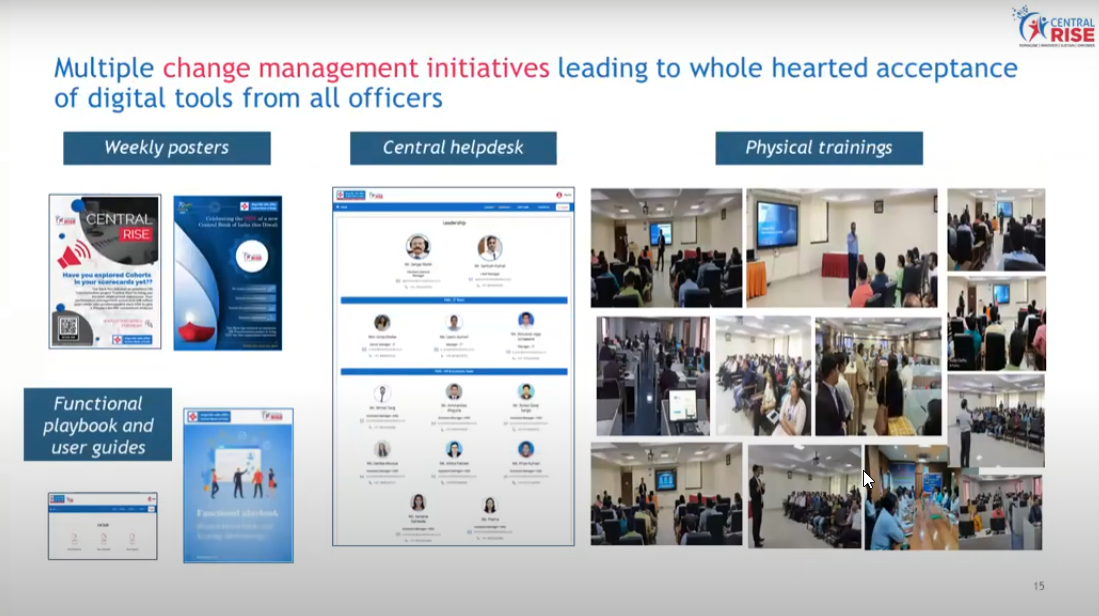

- New processes, curriculums, and delivery channels are defined to meet the emerging developmental needs of the Bank, such as Weekly “Information on the run”.

- New EVP is defined as attracting the best talent, which focuses on Credible Leadership, Career Progression, Caring Culture, Compliments and benefits.

Outcomes

- All officers and KRAs have been given personalised and relevant KRAs to ensure high accountability for all.

- Branch targets are based on overall Bank business objectives but customised to branch reality, set in a record period of 2 weeks post-March.

- Sufficient differentiation and fairness have been created through higher measurability of all employees and relative grading within “people like me” cohorts.

- New review rhythms are defined with personalised analytics-led feedback

- Ensured daily performance tracking and system-based analytical insights for better reviews and operating plan discussions.

SKOCH Award Nominee

Category: Public Sector Bank

Sub-Category: BFSI

Project: Technology – Strategic Transformation

Start Date: 2023-09-21

Organisation: Central Bank of India

Respondent: Ms Poppy Sharma, General Manager

www.centralbankofindia.co.in

Level: Premium

Video

See Presentation

Gallery

Case Study

Performance Management System for Banks

Introduction

Central Bank of India has embarked on an ambitious journey to transform its Performance Management System into a Performance Monitoring and Improvement System for all employees.

Problems

Earlier, 20% of officers felt accountable for bank targets and their performance was measured on overall branch performance. Negligible measurable KRAs were there for administrative officers, and no roles were defined for clerical staff.

Solutions

An intuitive digital tool is developed to ensure the right person gets the right role and KRAs. Employees can be allocated up to 3 roles (multi-hatting) to ensure that all responsibilities of the employee get covered. KRAs are auto-allocated based on the role combinations selected to ensure a mix of individual performance and unit-level performance to drive both individual and team accountability.

Outcomes

The solution has been enthusiastically accepted by all the employees, and so far, a total of 4.6 lakh page hits in the calendar year 2023, with extensive usage by the field functionaries. All officers and KRAs have been given personalised and relevant KRAs to ensure high accountability for all. Branch targets are still based on overall Bank business objectives but customised to branch reality, set in a record period of 2 weeks post-March.

Challenges

There was a lack of training culture, with regional heads nominating low-value-adding officers for training irrespective of relevance and a lack of structured rewards and recognition programs.

Innovation

New Employer Value Proposition attracts the best talent and focuses on Credible Leadership, Career Progression, Caring Culture, Compliments and benefits.

Opportunities

The initiatives had been scaled up from 500 officers (pilot) to 25,000+ employees. This solution can also be extended to thousands and lakhs of employees with the right infrastructure server, load balancer, etc.

Summary

The project is based on the Performance Management System of the Bank to make it into a Performance Monitoring and Improvement System for all employees, officers and clerks alike.

For more information, please contact:

Ms Poppy Sharma, General Manager at gmhrd@centralbank.co.in

(The content on the page is provided by the Exhibitor)

The best way to show your appreciation for this project is to click some advertisements and keep a count of how many you clicked. You will be asked for the number of advertisements that you clicked before you can vote. The money generated through this supports our social action.