NatCat Insurance – Muthoot Microfin Limited

Empowering Rural Communities: The Griha Raksha Home Insurance Initiative

Problem

- Lack of financial resources among rural and semi-urban clients to recover from significant property damage caused by unforeseen events.

- Limited awareness and accessibility of home insurance products in remote areas.

- Traditional insurance policies not adequately address the specific needs of low-income households.

- Complexity and time consumption in the claim settlement process deterring adoption.

- Insufficient education among clients about the importance and benefits of home insurance.

Solution

- Development of a cost-effective home insurance plan tailored to the needs of low-income and rural customers.

- Streamlined claim processes to ensure quick and hassle-free settlements.

- Utilization of an extensive branch network to enhance product accessibility.

- Creation of affordable plans starting at ₹160 with flexible coverage options.

- Conducting awareness campaigns and educating clients about the value of home insurance.

Outcomes

- Enhanced financial security for customers, protecting them from significant losses due to unforeseen events.

- Simplified claims process and prompt settlements improved customer satisfaction and loyalty.

- Strengthened brand reputation and market position by demonstrating commitment to customer welfare.

- Increased insurance literacy among clients in rural and underserved regions.

- A scalable product offering, reaching a broader customer base.

Challenges

- Designing an affordable home insurance plan with adequate coverage.

- Identifying appropriate coverage amounts to meet diverse customer needs.

- Raising awareness and convincing customers to invest in insurance plans.

- Addressing logistical hurdles in reaching remote and rural customers.

- Ensuring claim processes are seamless while maintaining regulatory compliance.

Innovations

- Introduction of affordable and flexible home insurance plans starting at low premiums.

- Implementation of a quick claim process with surveys initiated within 24 hours.

- Leveraging data analytics to identify trends and optimize operations.

- Customization of policies to cater specifically to low-income households’ unique needs.

- Employing the branch network for efficient customer reach and insurance literacy.

SKOCH Award Nominee

Category: BFSI

Sub-Category: Leadership – Sustainability

Project: NatCat Insurance

Start Date: 2-01-2019

Organisation: Muthoot Microfin Limited

Respondent: Subhransu Pattnayak

https://muthootmicrofin.com/

Level: BFSI – 4

Video

See Presentation

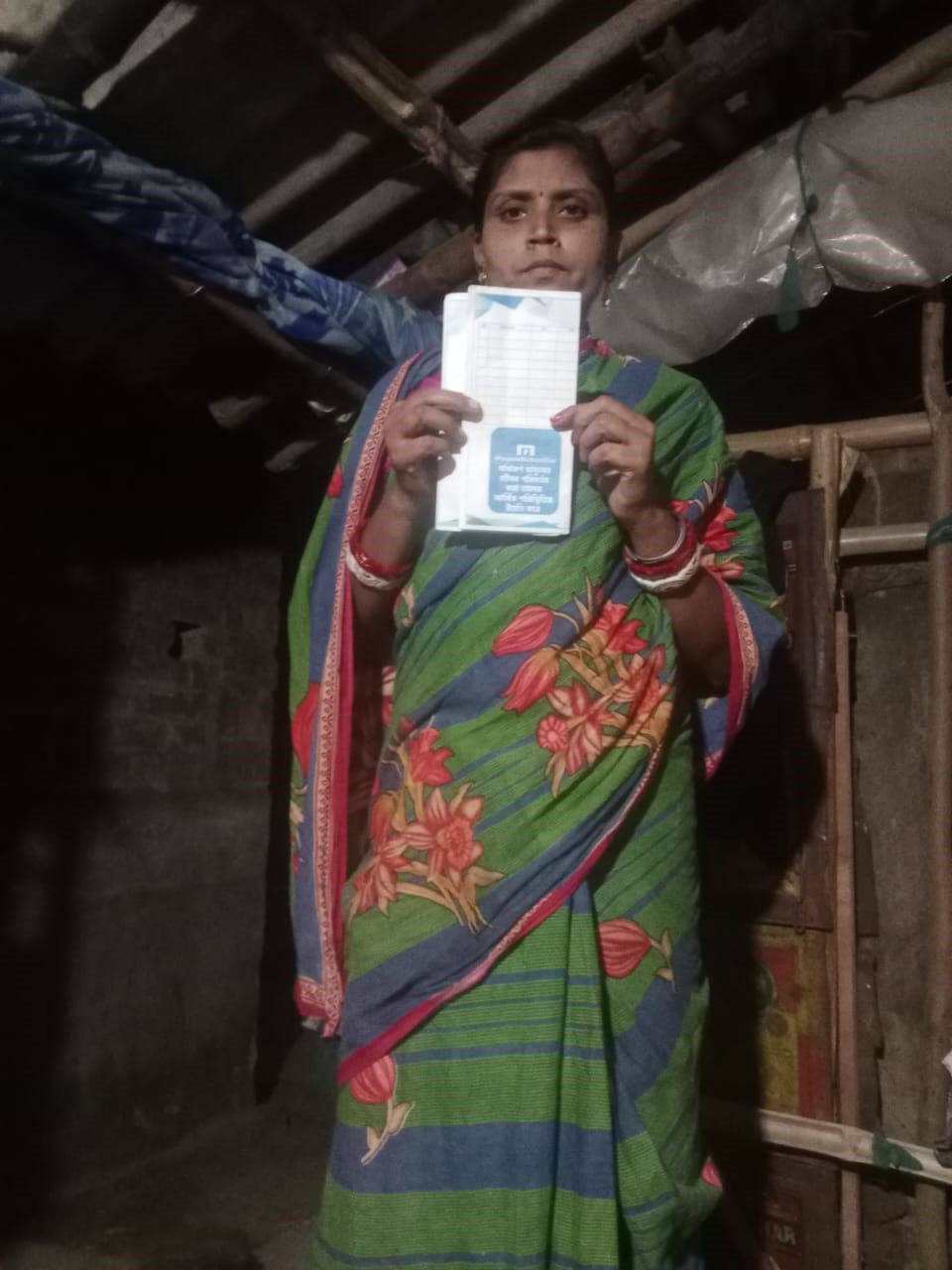

Gallery

Case Study

Empowering Rural Communities: The Griha Raksha Home Insurance Initiative

Introduction

Muthoot Microfin Limited, a prominent player in India’s financial inclusion landscape, has launched a revolutionary initiative named Griha Raksha. This home insurance plan is designed to address the unique challenges faced by low-income and rural households. By providing affordable and comprehensive insurance coverage, the project aspires to secure the financial stability of communities vulnerable to unforeseen events such as natural disasters. The initiative reflects Muthoot Microfin’s commitment to innovation, customer-centricity, and social impact.

The Problem

- Financial Vulnerability: Many clients in rural and semi-urban areas lack the resources to recover from significant property damage caused by unforeseen events.

- Lack of Awareness: Home insurance is often perceived as a luxury, and clients in remote areas are unaware of its importance.

- Inaccessibility of Products: Traditional insurance products are often out of reach for rural communities due to cost, complexity, and logistical challenges.

- Inadequate Coverage: Existing insurance policies fail to address the specific needs of low-income households, leaving them exposed to financial risks.

- Cumbersome Claim Processes: Complex and time-consuming claims deter potential clients from considering insurance as a viable safety net.

The Solution

Muthoot Microfin’s Griha Raksha plan was meticulously designed to tackle these challenges:

- Affordable and Flexible Plans: Starting at just ₹160, the insurance provides comprehensive coverage tailored to the financial capacity of low-income clients.

- Comprehensive Coverage: Policies cover up to ₹1 lakh for home structure and ₹20,000 for home contents, ensuring clients’ needs are met.

- Streamlined Claim Settlement: A swift and hassle-free claims process, with surveyors appointed within 24 hours of a claim being filed.

- Enhanced Accessibility: Leveraging an extensive branch network to ensure the product reaches even the most remote clients.

- Awareness Campaigns: Educating clients about the importance of home insurance and empowering them to make informed decisions.

Implementation Process

The development and deployment of the Griha Raksha plan followed a structured approach:

- Market Research: Extensive studies were conducted to identify the financial risks faced by rural households and the gaps in existing insurance products.

- Product Design: The insurance plan was customized to meet the specific needs of low-income households, focusing on affordability and accessibility.

- Awareness Campaigns: Through branch networks and local community programs, clients were educated about the benefits of home insurance.

- Claim Process Simplification: A robust system was developed to minimize paperwork and expedite claim settlements.

- Continuous Improvement: Feedback loops and data analytics were employed to refine the product and optimize its reach and effectiveness.

Outcomes

The Griha Raksha initiative has achieved remarkable success in its objectives:

- Financial Security: Over 2.6 million clients have been protected from significant financial losses due to unforeseen events.

- Customer Satisfaction: The simplified claim process and prompt settlements have improved client satisfaction and loyalty.

- Brand Reputation: The initiative has reinforced Muthoot Microfin’s market position as a socially responsible organization committed to customer welfare.

- Increased Insurance Literacy: Awareness campaigns have empowered rural clients with knowledge about the importance and benefits of home insurance.

- Scalability: The extensive branch network has enabled the plan to reach a broader customer base, with future growth potential in underserved areas.

Challenges Faced

- Affordable Coverage: Designing a product that balanced affordability and comprehensive coverage was a significant hurdle.

- Awareness Gaps: Convincing clients of the importance of insurance required sustained efforts in education and community engagement.

- Diverse Needs: Identifying appropriate coverage amounts to suit the varied requirements of customers posed a challenge.

- Logistical Issues: Reaching clients in remote areas demanded efficient coordination and extensive groundwork.

- Regulatory Compliance: Ensuring adherence to insurance regulations while maintaining customer-centric processes was an ongoing task.

Innovations

The Griha Raksha plan introduced several groundbreaking innovations:

- Affordable Premiums: Policies starting at ₹160 made home insurance accessible to low-income households.

- Prompt Claims Processing: The initiative’s 24-hour claim survey mechanism set a new benchmark for efficiency in the sector.

- Tailored Solutions: Policies were designed to address the unique vulnerabilities of rural clients, including coverage for natural disasters.

- Data-Driven Insights: Advanced analytics were employed to identify customer needs and optimize operational efficiency.

- Community Outreach: Leveraging local networks to disseminate information and drive awareness ensured widespread adoption.

Lessons Learned

The Griha Raksha initiative highlighted valuable insights:

- Adaptability: Tailoring solutions to suit the unique needs of different customer segments is crucial for success.

- Education: Raising awareness and simplifying complex financial products can significantly improve adoption rates.

- Efficiency: Streamlined processes, such as simplified claims and reduced paperwork, enhance customer satisfaction.

- Collaboration: Strong partnerships with local communities and leveraging branch networks are essential for reaching underserved areas.

- Continuous Improvement: Utilizing data analytics to monitor trends and refine products ensures long-term sustainability.

Conclusion

The Griha Raksha home insurance plan by Muthoot Microfin Limited is a transformative initiative addressing critical gaps in financial security for rural and low-income households. By offering affordable, accessible, and comprehensive coverage, the project has empowered over 2.6 million clients, safeguarded their assets, and contributed to the socio-economic upliftment of vulnerable communities. Its innovative approach and commitment to customer welfare have set a benchmark for inclusive insurance solutions, reaffirming Muthoot Microfin’s position as a leader in financial inclusion.

For more information, please contact:

Subhransu Pattnayak at subhransu.pattnayak@muthootmicrofin.com

(The content on the page is provided by the Exhibitor)