Indie for Business – MSME Mobile Banking App – IndusInd Bank

Indie for Business – MSME Mobile Banking App

Problem

- MSMEs faced delays and paperwork in account opening, loans, and payments due to manual processes.

- Fragmented financial management tools made it hard to track loans, payments, and accounts centrally.

- Compliance (e.g., TDS, GST) was time-consuming and error-prone, increasing penalty risks.

- Delayed payments from clients disrupted cash flow and growth planning.

- Limited digital literacy and scattered tools slowed adoption of formal banking by MSMEs.

Solution

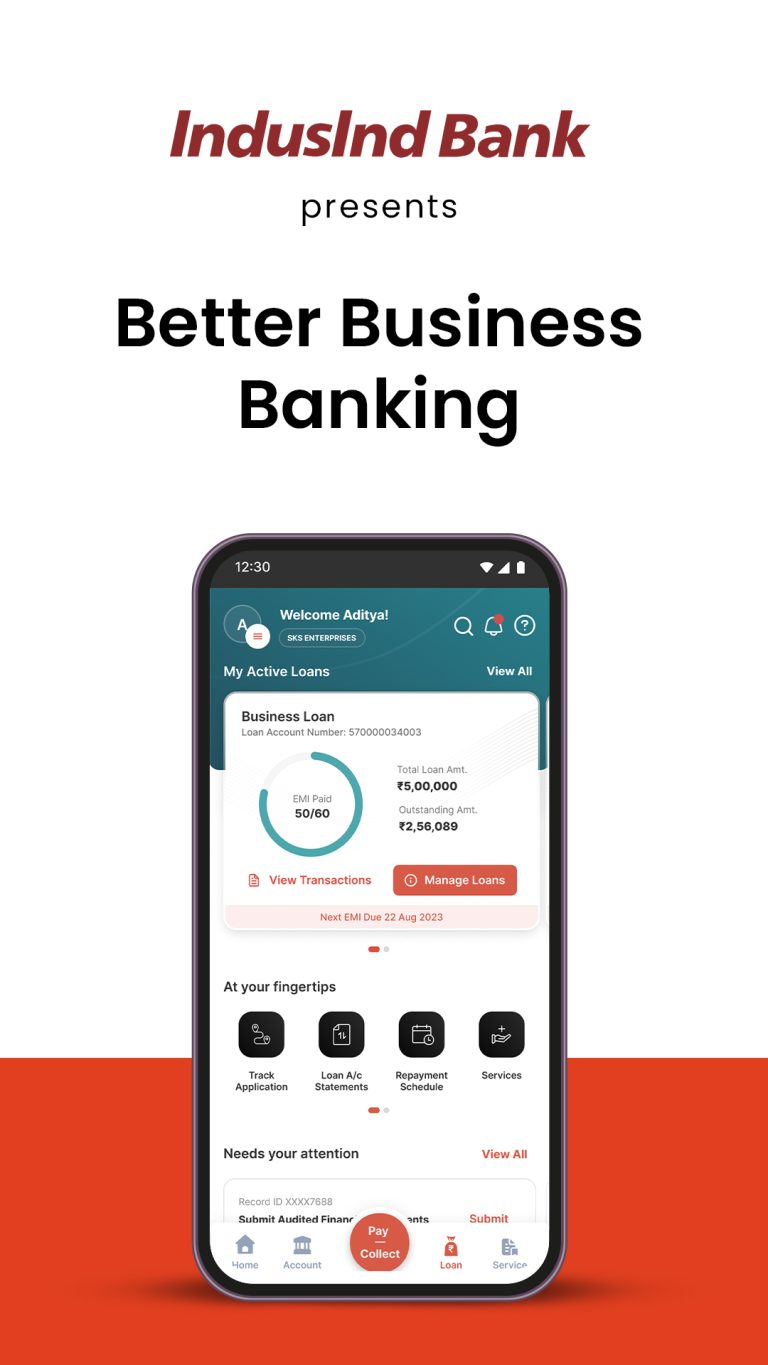

- Launched Indie for Business app for MSMEs with instant digital onboarding and paperless processes.

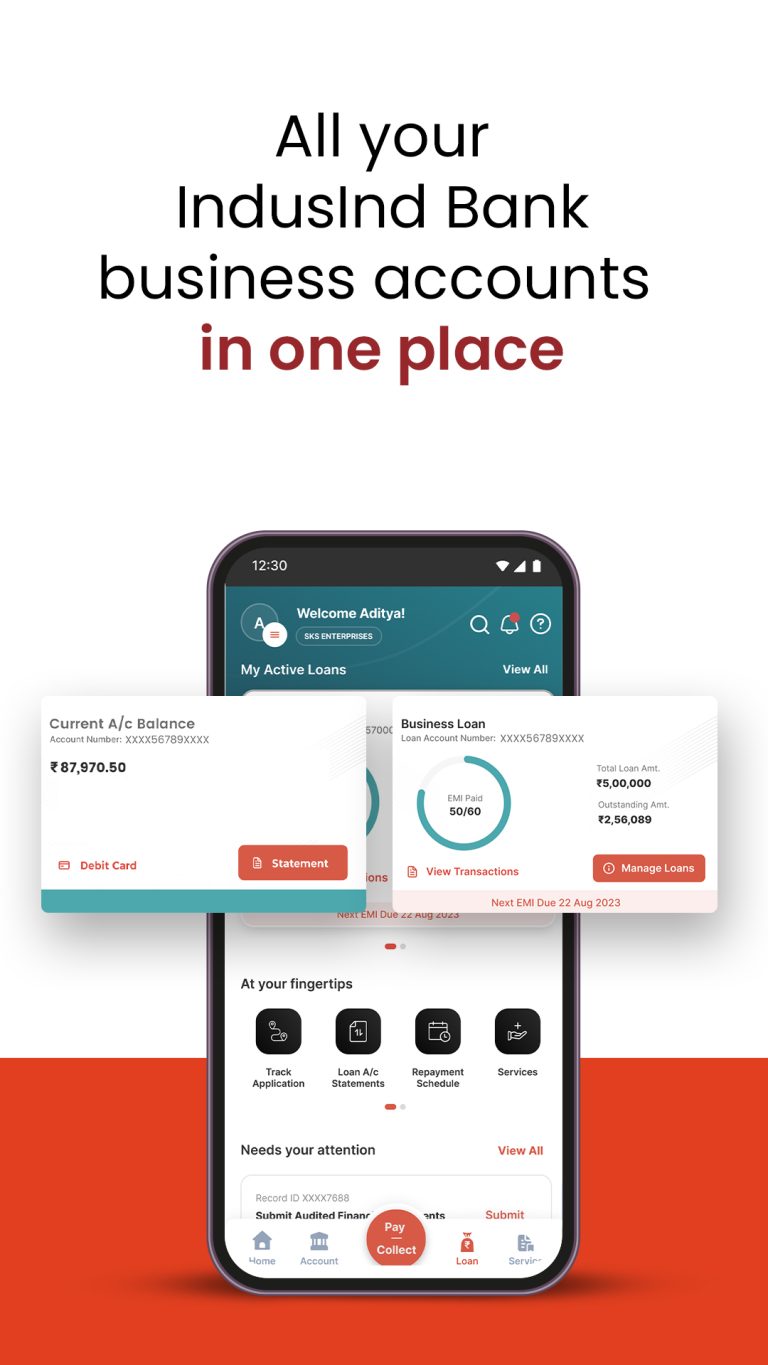

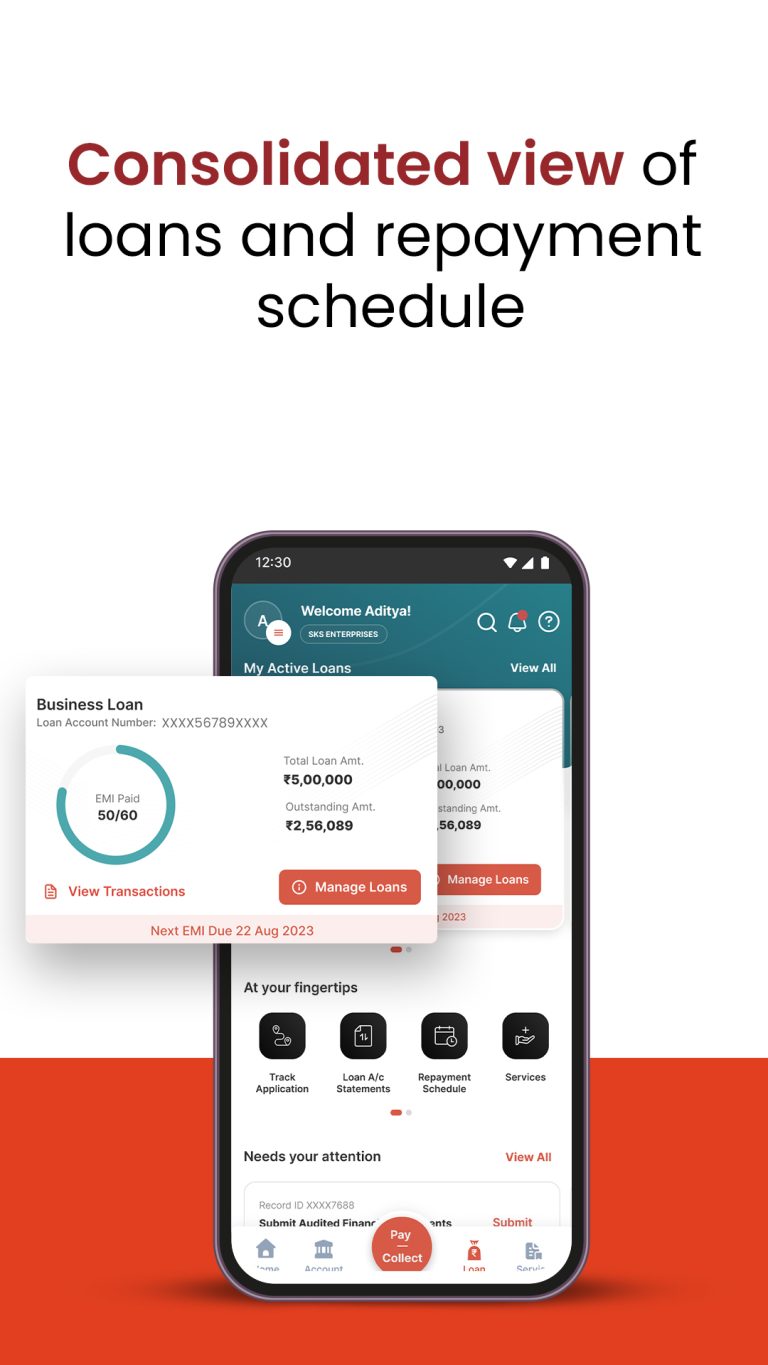

- Enabled 360° account view across loans, overdrafts, and transactions.

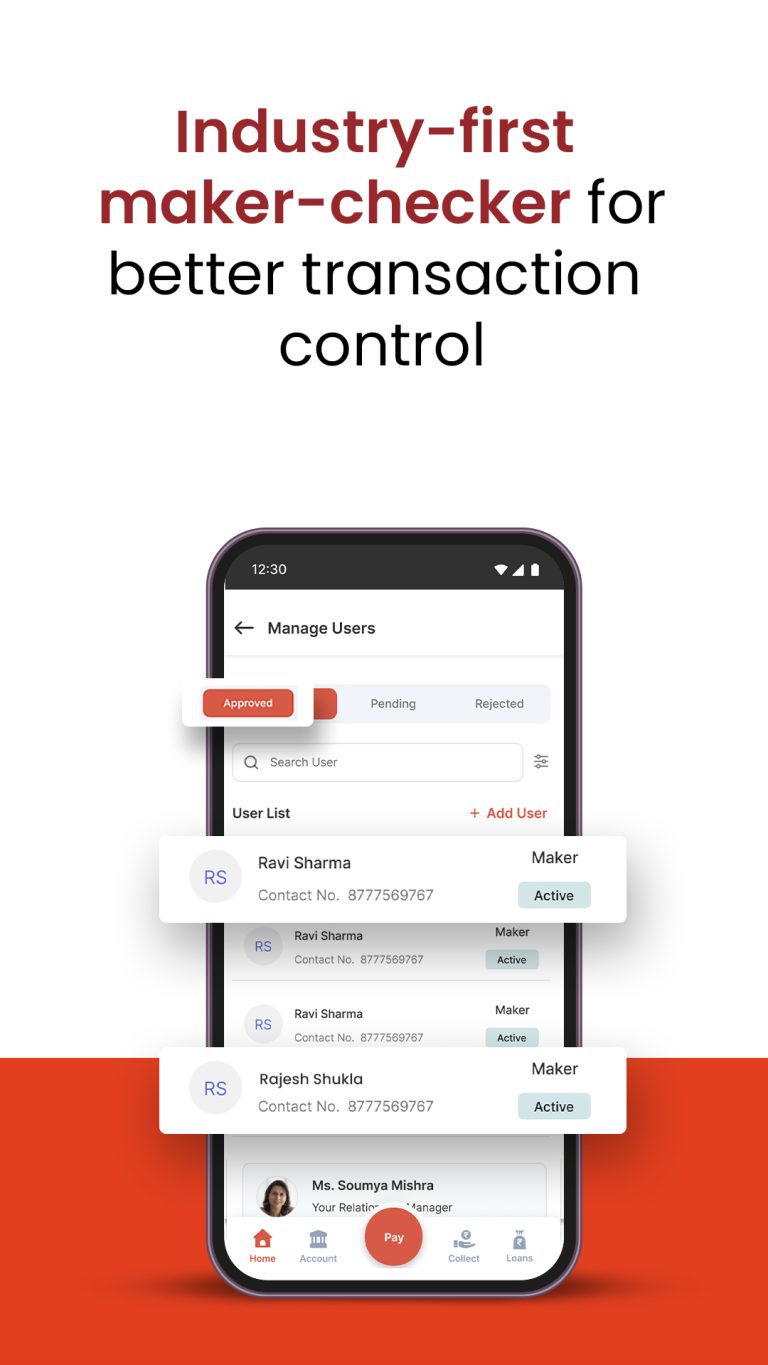

- Integrated smart tools: maker-checker workflows, FD-backed lending, bulk and tax payments.

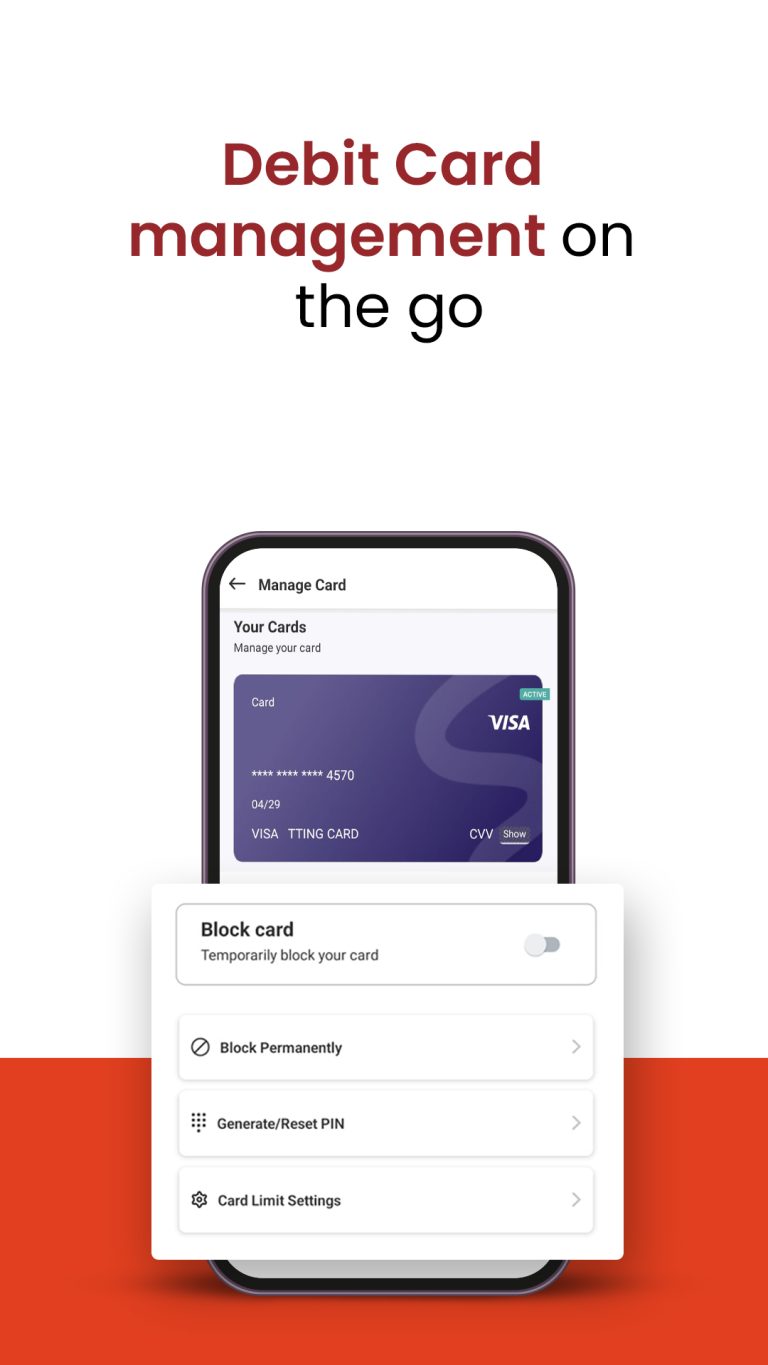

- Provided DIY features: FD/RD booking, debit card management, QR/POS ordering, loan tracking.

- Supported in-app GST challan generation, Aadhaar-based login, and multilingual UX for rural MSMEs.

Outcomes

- 1.3 lakh+ app downloads within 6 months; 90k+ MSMEs onboarded; 75% monthly active users.

- Enabled self-onboarding, sub-user management, and FD-backed lending for small firms.

- Reduced payment failures and loan processing time, improving MSME cash flow and planning.

- Improved financial inclusion by reaching unbanked semi-urban MSMEs via mobile banking.

- Positioned IndusInd Bank as a digital-first MSME banking leader in India.

Challenges

- No centralised digital record of the user authorisation matrix of MSMEs

- Users with multiple IndusInd accounts found it confusing to differentiate between the mobile apps

- Legacy platforms that are not API native by design

- Ensured robust cybersecurity without compromising user experience by integrating secure features

- Re-engineered legacy systems that were not API-native using techniques.

SKOCH Award Nominee

Category: Digital Transformation

Sub-Category: Digital Strategy and Innovation

Project: Indie for Business – MSME Mobile Banking App

Start Date: 16-02-2024

Organisation: IndusInd Bank

Respondent: Charu Mathur

https://www.indusind.com/

Level: DX – 2

Video

See Presentation

Gallery

Case Study

Indie for Business – MSME Mobile Banking App – IndusInd Bank

IndusInd Bank launched the “Indie for Business” mobile and web banking platform in December 2024 to serve India’s 64-million-strong MSME sector. Built for mobile-first entrepreneurs, freelancers, and small businesses, the app addresses critical pain points—delayed account setup, inefficient fund management, low formal credit access, and regulatory compliance hurdles.

During the initial ideation in Q1 FY 24, stakeholder interviews with MSMEs, startups, and freelancers revealed a strong demand for mobile banking tools that offered a unified financial view. The strategy phase followed, focusing on a modular, scalable architecture aligned with user needs. Key use cases were prioritized, including tax filing, loan application, payments, and account services.

The app’s interface was designed using agile UX methodologies, tested for accessibility, and optimized for multiple devices and internet bandwidths. Backend systems were integrated with IndusInd’s core banking, payment rails, and merchant APIs. Features like instant onboarding via Aadhaar, SIM binding, and debit card mapping ensured smooth adoption.

Post-launch in June 2025, the app delivered 90k+ MSME onboardings, with 1.3 lakh downloads across Android and iOS. More than 25% of users completed financial transactions monthly, and 75% remained active. Every fifth user was a new-to-bank customer. Popular features included bulk payments, QR and POS device ordering, and GST filing support.

To enhance scalability, Indie for Business was built on a cloud-native, API-driven stack supporting BaaS models and third-party integration. This helped the app evolve rapidly. FD-backed overdrafts (FDOD), merchant soundboxes, and trade remittance services were added post-launch.

MSME feedback loops were built via app ratings and in-app feedback. Challenges like onboarding failures, legacy system integration, and customer support bottlenecks were addressed via automation and backend enhancements. The bank also launched vernacular support, contextual nudges, and UI improvements to better serve non-tech-savvy users.

The project showcased how strategic digital innovation can empower MSMEs at scale. By providing intuitive, accessible, and secure mobile banking, IndusInd Bank helped MSMEs digitize financial operations, save time, and improve compliance.

For more information, please contact:

Charu Mathur at charu.mathur@indusind.com

(The content on the page is provided by the Exhibitor)