Technology Umbrella – The Gujarat State Cooperative Bank Ltd

Technology Umbrella

Problem

- Sub-member banks were unable to afford the cost of independent infrastructure

- Lack of technically trained staff at smaller cooperative banks made implementation of digital services difficult.

- Day-to-day IT and system monitoring was inconsistent and error-prone

- Cybersecurity risk management posed a significant challenge without dedicated IT resources.

- Regulatory compliance burdens made it harder for sub-member banks to operate efficiently

Solution

- Created a shared digital infrastructure hub at GSC Bank to host services for sub-member banks

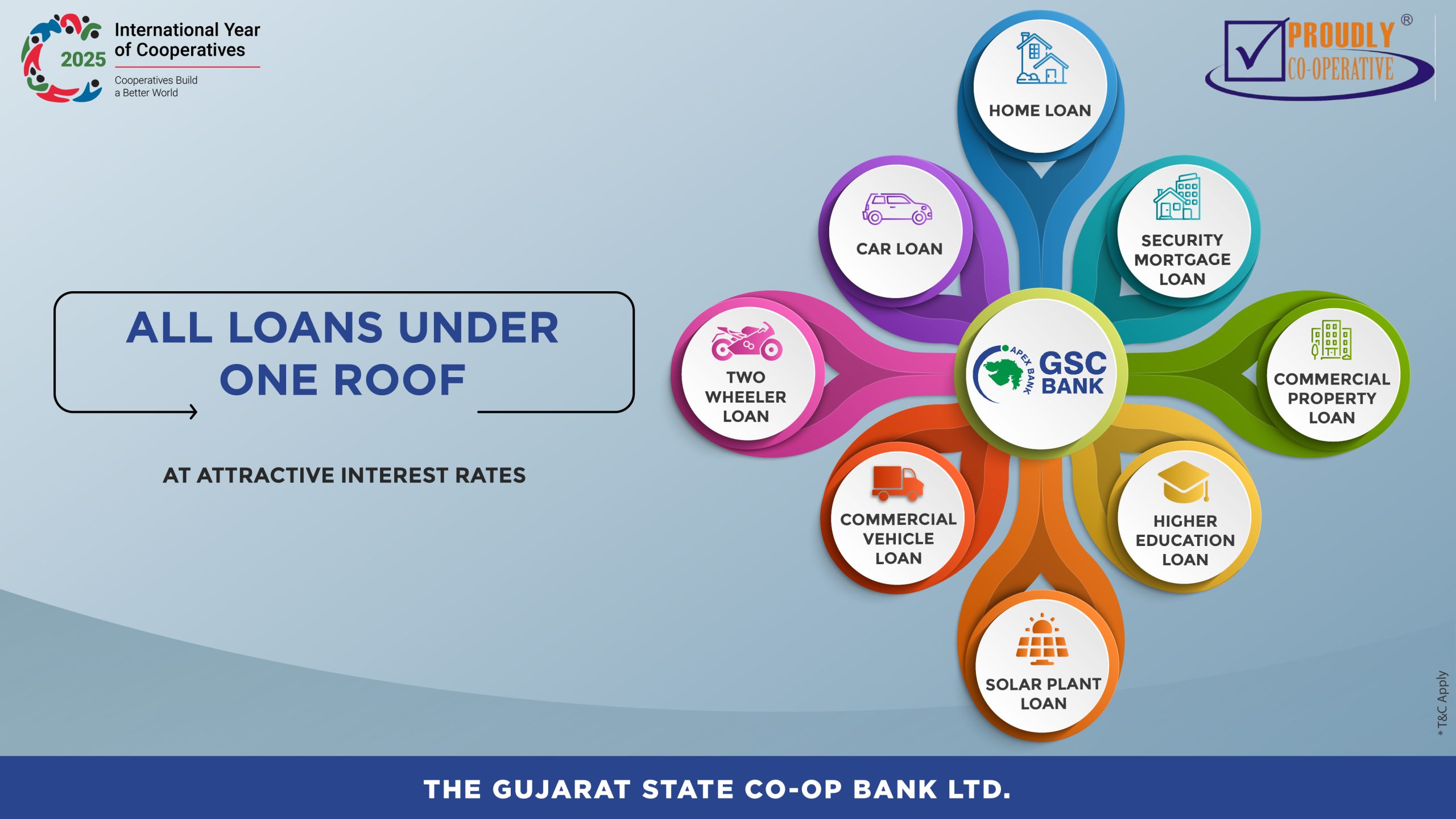

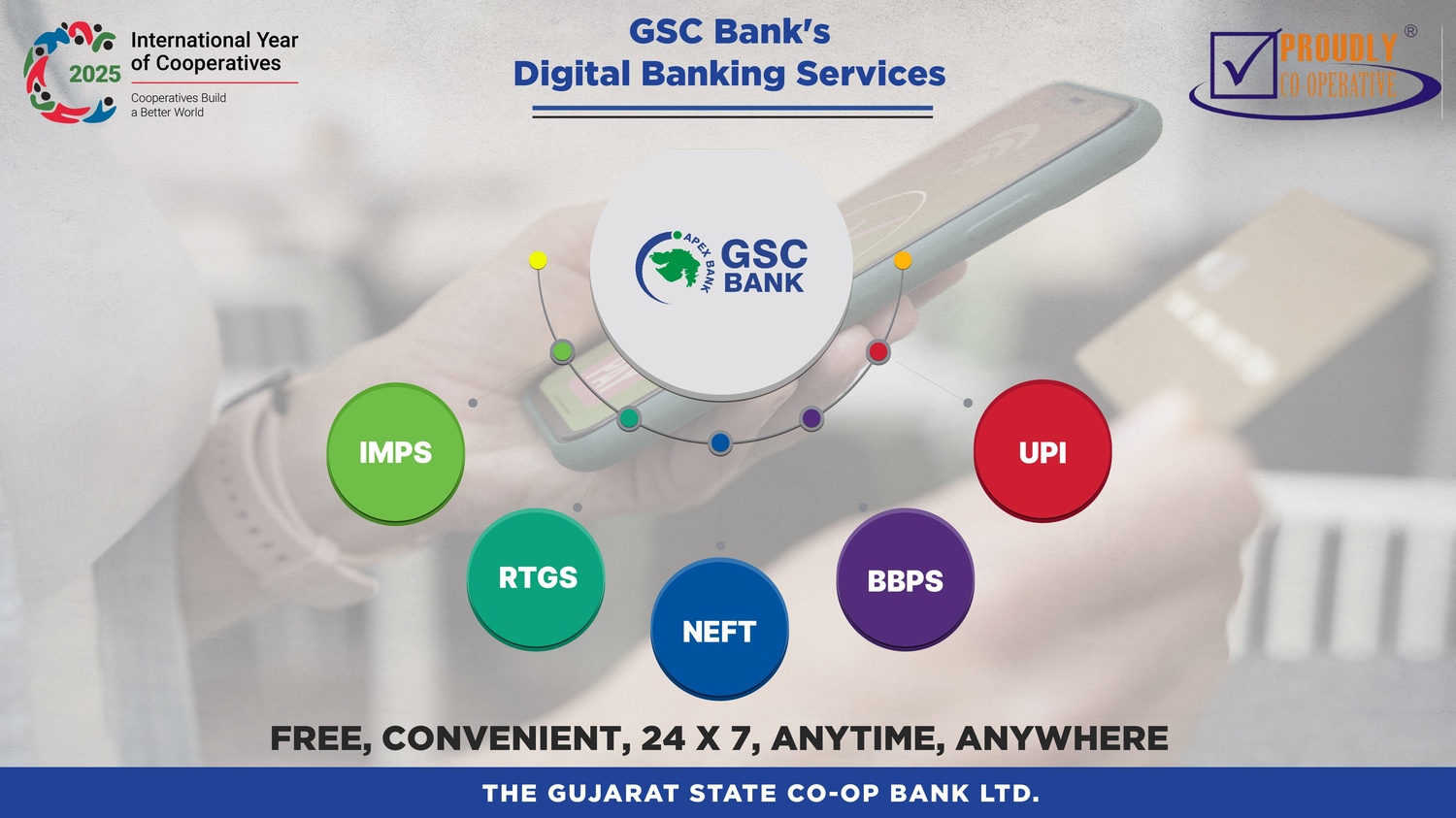

- Enabled access to RTGS/NEFT, CTS, CSGL, ATM, IMPS, UPI, BBPS and NACH through a single umbrella system

- Provided end-to-end regulatory audit compliance and certifications.

- Developed SOPs and onboarding frameworks for new sub-member banks

- Signed MoUs with DCCBs and UCBs for shared governance and service delivery

Outcomes

- 170 external and 90,000 internal users now seamlessly access digital financial services

- Reduced infrastructure duplication and lowered total cost of technology ownership

- Enhanced cybersecurity posture of smaller banks through centrally managed systems.

- Won multiple awards from NABARD, NAFSCOB, and Government of Gujarat for technological leadership

- Enabled financial inclusion in underserved rural areas via cooperative digital enablement

SKOCH Award Nominee

Category: BFSI

Sub-Category: Technology – Digital Banking

Project: Technology Umbrella

Start Date: 6-01-2013

Organisation: The Gujarat State Cooperative Bank Ltd

Respondent: Ramji Chavda

https://gscbank.co.in/

Level: BFSI – 2

Video

See Presentation

Gallery

Case Study

Technology Umbrella – The Gujarat State Cooperative Bank Ltd

The Technology Umbrella initiative by The Gujarat State Cooperative Bank Ltd (GSC Bank) represents a transformative digital backbone developed to support cooperative banking institutions across Gujarat. The program began in 2013 with the objective of overcoming technology access barriers faced by smaller cooperative banks, especially district and urban cooperative banks that lacked capital, technical capacity, and IT staff.

The concept was simple yet powerful: enable these banks to become sub-members under GSC Bank’s infrastructure and offer them seamless access to core banking services, digital payments, and regulatory frameworks. This significantly reduced the need for individual banks to invest in costly infrastructure, hire IT personnel, and manage cybersecurity on their own.

By becoming a direct member of institutions like NPCI, RBI, UIDAI and others, GSC Bank was able to centralize regulatory and technical compliance for sub-member banks. Every service—RTGS, NEFT, IMPS, UPI, BBPS, NACH, CTS—was routed through GSC Bank’s platform, with secure and monitored access points for each participating sub-member.

The implementation followed a carefully planned sequence. First, certifications and regulatory audits were completed. Then, banks were onboarded through a standardized SOP-based process. Agreements were signed, access controls were configured, and operational monitoring systems were installed. GSC Bank also ensured that any bank-specific customizations were built into the shared platform.

This initiative not only improved service delivery and operational reliability but also reduced the threat surface for cyberattacks. GSC Bank’s team maintained and upgraded all infrastructure centrally, ensuring fast adoption of emerging cybersecurity protocols. In doing so, even the smallest rural banks could offer their customers world-class banking experiences.

The cooperative sector, traditionally seen as slow-moving and analog, has been revitalized in Gujarat through this initiative. By supporting 170 external and 90,000 internal users, GSC Bank has created a sustainable ecosystem where digital banking is no longer a privilege but a cooperative right.

For more information, please contact:

Ramji Chavda at ramji.chavda@gscbank.coop

(The content on the page is provided by the Exhibitor)