GST MITHRA – Commercial Taxes Department , Andhra pradesh

GST Mithra: Enhancing Taxpayer Self-Compliance and Transparency

Problem

- Taxpayers lack access to authorized IT tools for analyzing self-assessed GST returns and identifying discrepancies.

- Taxpayers frequently do not correct their errors voluntarily, resulting in penalties and increased compliance costs.

- Tax authorities spend substantial time on minor discrepancies, which diverts their resources from addressing cases of willful tax evasion.

- Lack of trust and transparency between taxpayers and tax authorities, which can lead to potential harassment and corruption.

- Absence of effective tools and mechanisms to facilitate self-assessment leads to inconsistent compliance and inefficiencies in tax administration.

Solution

- Developing an IT-based automation tool to enable taxpayers to self-identify discrepancies in their GST returns.

- Identifying and automating key parameters to generate detailed reports on discrepancies, simplifying the self-correction process for taxpayers.

- Ensuring accurate and reliable data by cleaning and merging various datasets to produce comprehensive reports.

- Incorporating real-time updates of changes in GST laws and rules into the GST MITHRA tool, keeping the system current and effective.

- Automated verification provided under GST Mithra reduces the likelihood of human errors.

Outcomes

- GST Mithra simplifies tax compliance by automatically highlighting discrepancies, making the process more user-friendly for taxpayers.

- Reduces the financial burden on businesses by providing free tool, enabling them to self-correct and enhance their self-reliance.

- Promotes transparency, fosters trust, and mitigates potential harassment by delivering clear, objective information to taxpayers.

- GST Mithra’s self-correction capabilities allow tax authorities to concentrate on serious tax evasion cases.

- Serves as a model for other departments, advocating for objectivity, accountability, and openness in public administration.

Challenges

- Integrating new technology with existing systems while ensuring data security for external stakeholders was challenging.

- Managing and ensuring the accuracy, security, and timeliness of large volumes of data was complex.

- Training taxpayers to efficiently use the tool was a significant hurdle.

- Continuously incorporating GST Act changes and amendments in real time was demanding.

- Ensuring the security of sensitive financial information during tool implementation was a critical challenge.

SKOCH Award Nominee

Category: State Government – Finance

Sub-Category: State Government – Finance

Project: GST MITHRA

Start Date: 6-05-2023

Organisation: Commercial Taxes Department , Andhra pradesh

Respondent: Mandalika Girija Shankar

https://aptis.apct.gov.in/APTis/Reports/GST_MITHRA.aspx

Level: Premium Plus

Video

See Presentation

Gallery

Case Study

GST Mithra: Enhancing Taxpayer Self-Compliance and Transparency

Problems

The lack of authorized IT tools for taxpayers to analyze self-assessed GST returns leads to difficulties in identifying discrepancies. Many taxpayers lack self-correcting mechanisms, resulting in penalties and increased compliance costs. Tax authorities are burdened with addressing minor discrepancies, diverting resources from tackling significant tax evasion issues. Additionally, there is often a lack of trust and transparency between taxpayers and tax authorities, potentially leading to harassment and corruption.

Solutions

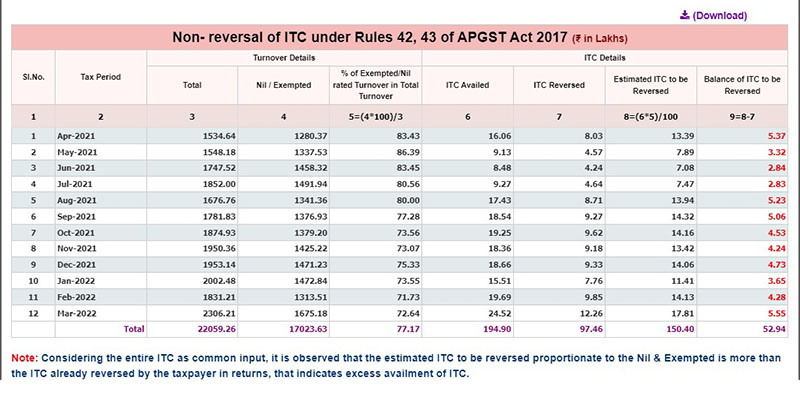

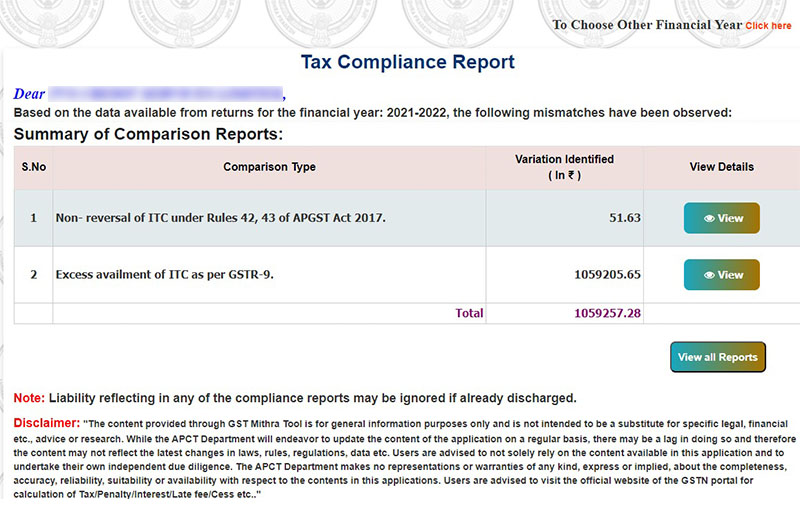

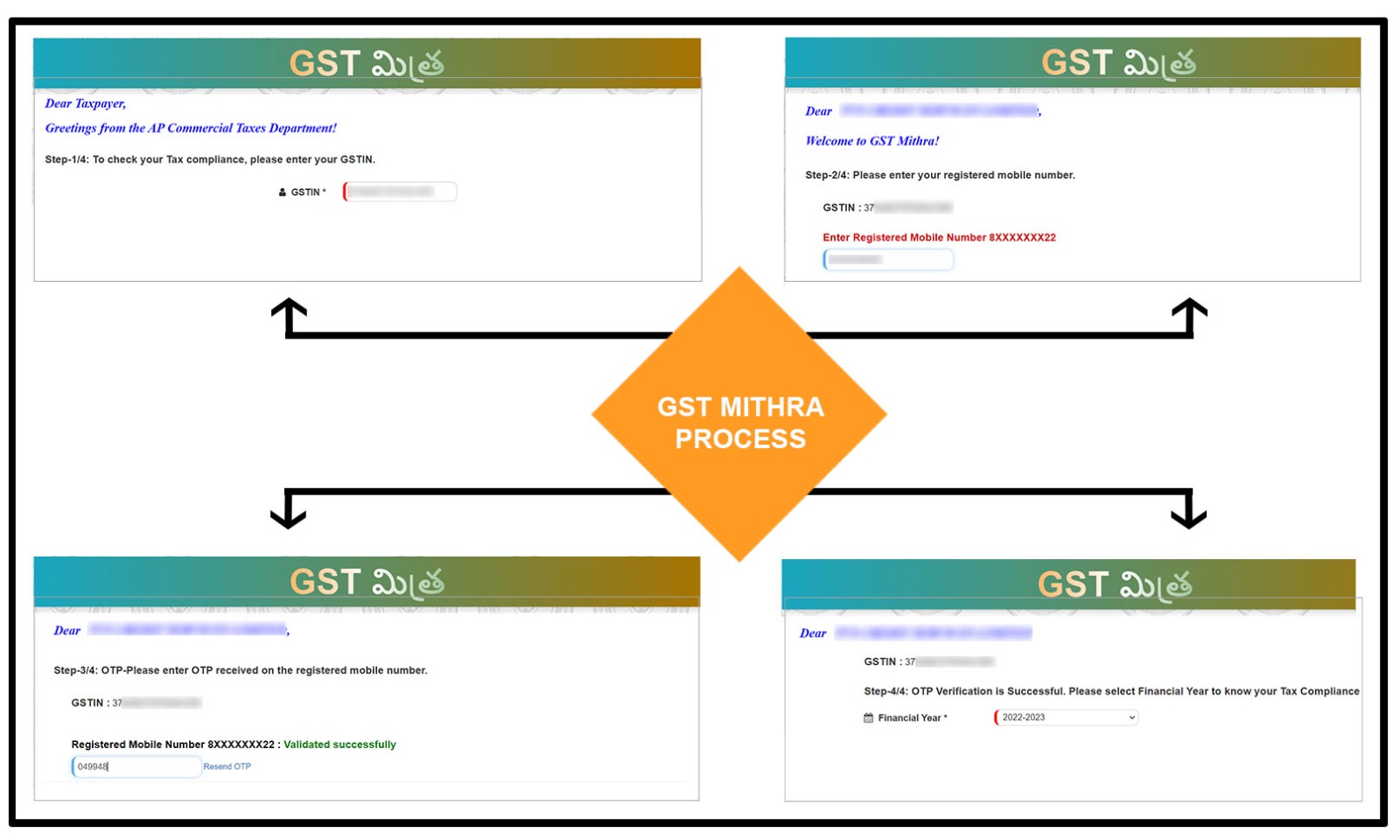

To address these issues, an IT-based automation tool called GST Mithra was developed to help taxpayers identify discrepancies in their returns. Key solutions included automating critical parameters to generate discrepancy reports, ensuring data accuracy and integration, and incorporating real-time updates of GST regulations into the tool. This proactive approach simplifies compliance for taxpayers and improves overall efficiency.

Outcomes

GST Mithra offers an easy-to-use tool that automatically highlights discrepancies, simplifying tax compliance. By providing a free tool, it reduces the financial burden on businesses, fostering self-reliance. The tool enhances transparency and trust, reducing harassment and enabling the department to focus on more serious cases of tax evasion. It also serves as a model for promoting objectivity and openness in public administration.

Challenges

Implementing GST Mithra involved integrating new technology with existing systems while ensuring secure exposure of critical tax data. Managing large volumes of data required accurate, secure, and up-to-date information. Training external stakeholders to use the tool effectively posed a challenge, as did incorporating real-time changes to GST regulations.

Innovation

The innovation behind GST Mithra lies in its groundbreaking approach as the first initiative of its kind in India by the Andhra Pradesh Commercial Taxes Department. The tool empowers taxpayers to self-identify and correct discrepancies in their GST returns, simplifying tax compliance and reducing reliance on costly third-party services.

Opportunities

In the future, the department would like to integrate external 3rd party data sources such as RERA, Municipal Administration and IT into the tool, increasing the effectiveness of the GST Mithra tool.

Summary

The GST Mithra project, developed by the Andhra Pradesh Commercial Taxes Department, is an innovative tool that empowers taxpayers to easily identify and correct discrepancies in their GST returns. By automating the verification process, GST Mithra simplifies tax compliance, reduces the need for third-party services, and minimizes human errors. This initiative promotes transparency, enhances trust between taxpayers and authorities, and allows tax officials to focus on significant evasion cases, improving overall efficiency in tax administration.

For more information, please contact:

Mandalika Girija Shankar at ap_cct@apct.gov.in

(The content on the page is provided by the Exhibitor)