APCTD DASHBOARD – Commercial Taxes Department , Andhra pradesh

APCTD Dashboard

Problem

- There is no single point IT solution for effective tax administration.

- The taxman does not have data analytics-based Intelligence support to control tax evasion.

- The absence of Complete IT based system that captures end to end details of important Business processes in GST makes it difficult.

- Absence of an interactive platform for cross-learning among the State Tax department’s officials.

- Absence of a system that closely monitors all important milestones of various statutory functions of tax officers.

Solution

- Identification of important parameters of tax administration to be encapsulated in the dashboard.

- The logic design for preparation of analytical reports which are over-encompassing and proved to be highly beneficial.

- Identification of roles for provision of role-based access.

- Defining metrics helping the field officers in the process of self-assessment and peer group comparison.

- Enabling access to success stories, testimonials, sector profiling, other knowledge updates to foster cross-learning.

Outcomes

- Effectively integrating systems working in silos into a single MIS system.

- Frequent updating of systems based on decisions taken by GST Council.

- Scalability for future use, to able to expand for higher number of taxpayers.

- Change management in bureaucracy who were used to Pre-GST modules.

- Absence of a system that closely monitors all important milestones of various statutory functions of tax officers.

Challenges

- The implementation of Dashboard has empowered tax administrations with timely insights, transparency, and the ability to make data-driven decisions.

- Through its multifaceted approach, the initiative seeks to not only empower officers with the requisite resources.

- The overarching goal of the GST Knowledge Hub under dashboard extends beyond inter-departmental operations.

- The initiative endeavors to enhance the efficiency of tax administration.

- The Knowledge Hub’s peer learning initiative promotes continuous learning and collaboration among officers.

SKOCH Award Nominee

Category: State Government – Finance

Sub-Category: State Government – Finance

Project: APCTD DASHBOARD

Start Date: 4-06-2023

Organisation: Commercial Taxes Department , Andhra pradesh

Respondent: Mandalika Girija Shankar

https://aptis.apct.gov.in/apdashboard/

Level: Premium Plus

Video

See Presentation

Gallery

Case Study

APCTD Dashboard

Introduction:

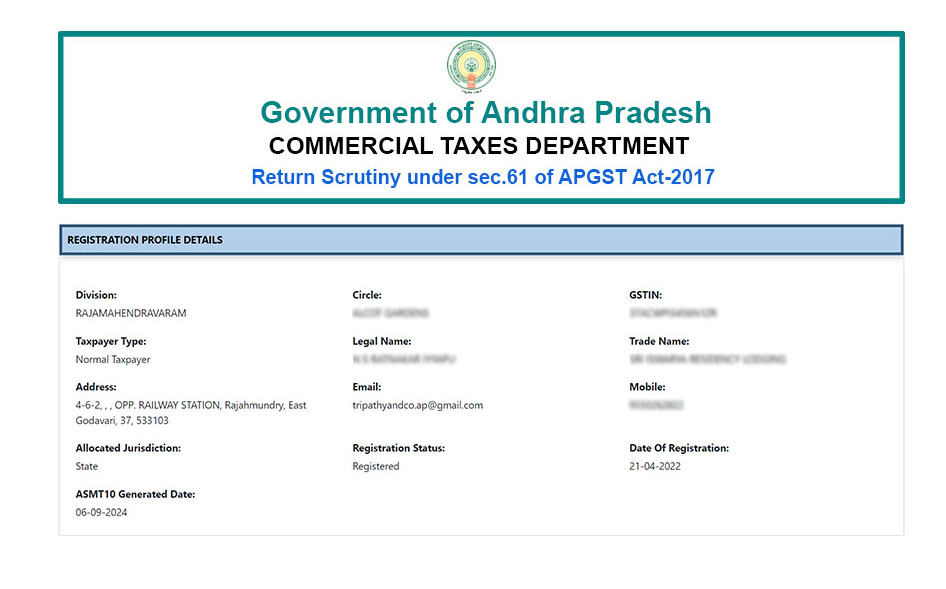

AP Commercial Taxes Department (APCTD) has developed a dashboard to provide a real-time display of all milestones in the performance of tax officials, categorized into process, analytical, and revenue reports. Tax officials can utilize this tool for self-motivation and self-supervision.

Problems:

There is no single-point IT solution for effective tax administration. The taxman does not have data analytics-based Intelligence support to control tax evasion. The absence of Complete IT-based system that captures end-to-end details of important Business process in GST makes it difficult. The absence of an interactive platform for cross-learning among the State Tax Department’s officials and also the absence of a system that closely monitors all important milestones of various statutory functions of tax officers.

Solution:

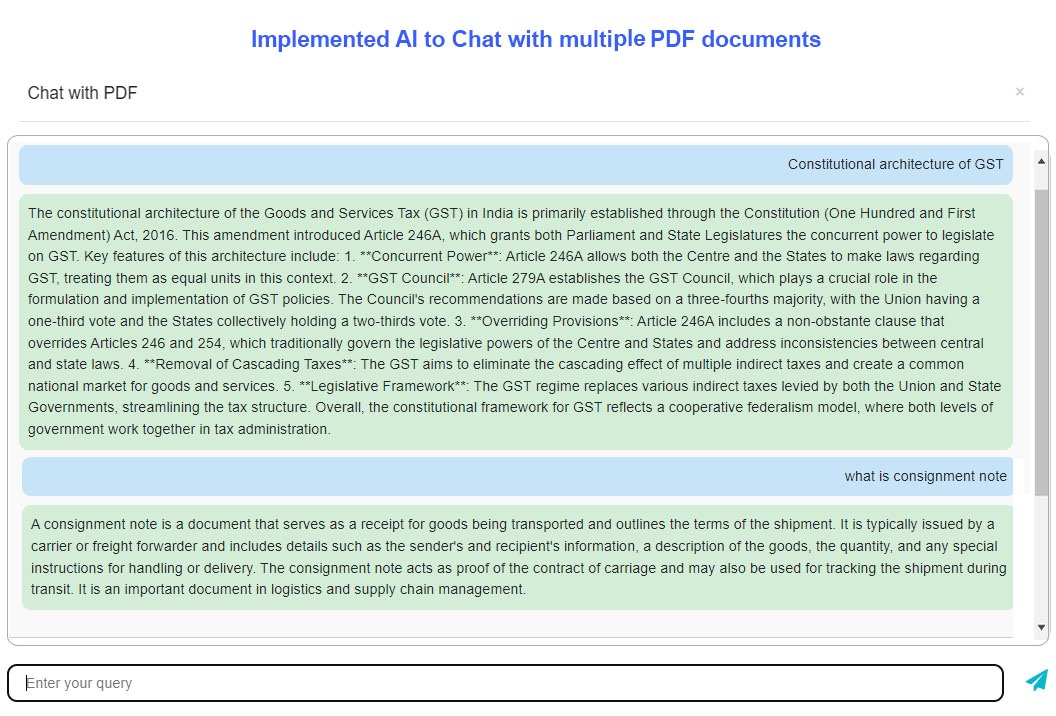

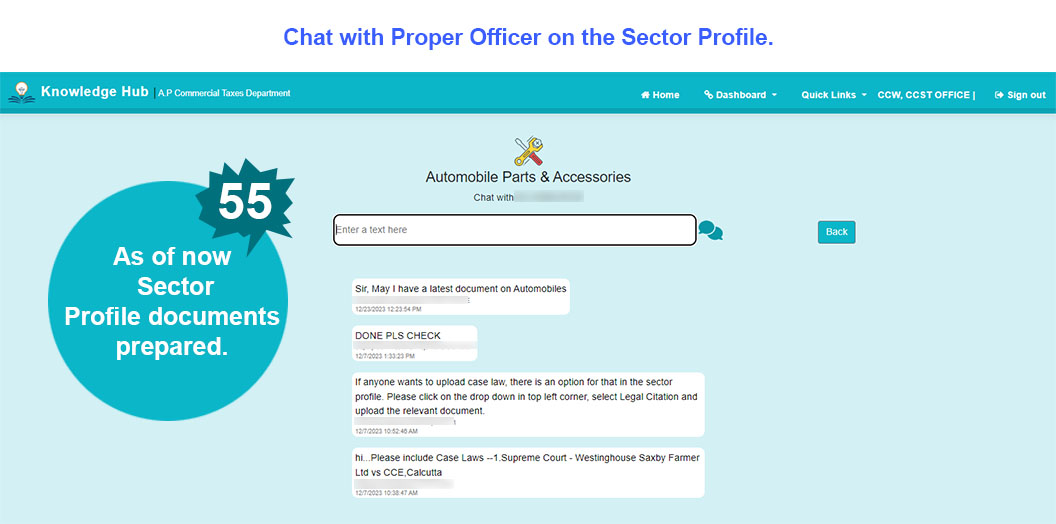

Identification of important parameters of tax administration to be encapsulated in the dashboard. The logic design for the preparation of analytical reports which are over-encompassing and proved to be highly beneficial. Defining metrics helps the field officers in the process of self-assessment and peer group comparison. Enabling access to success stories, testimonials, sector profiling, and other knowledge updates to foster cross-learning.

Challenges:

Effectively integrating systems working in silos into a single MIS system and frequent updating of systems based on decisions taken by the GST Council was a challenge. Scalability for future use, to able to expand for a higher number of taxpayers and change management in the bureaucracy who were used to Pre-GST modules also posed a challenge. Absence of a system that closely monitors all important milestones of various statutory functions of tax officers.

Innovation:

The dashboard is proving to be a single-point solution for monitoring multiple stages involving business processes, data analytics, and revenue monitoring, facilitating tax administration to function towards increased efforts on tax revenue maximization. The platform also offers field-level officers the ability to evaluate their position in day-to-day activities, serving as a yardstick tool for them, and instilling motivation to perform better in the workplace.

Outcomes:

The implementation of Dashboard has empowered tax administrations with timely insights, transparency, and the ability to make data-driven decisions. Through its multifaceted approach, the initiative seeks to not only empower officers with the requisite resources. The overarching goal of the GST Knowledge Hub under the dashboard extends beyond inter-departmental operations. The Knowledge Hub’s peer learning initiative promotes continuous learning and collaboration among officers.

Opportunities:

The APCT dashboard is the epitome of Excellency as far as the Tax Administration of any State Government is concerned. It is continuously getting enriched to meet the changing needs of the department.

Summary:

The dashboard has demonstrated its impact on improving tax compliance rates and enhancing revenue generation for the government by allowing easy measurement of the department’s performance against predefined targets and benchmarks. The project signifies the department’s embrace of innovation and technological advancement in tax administration.

For more information, please contact:

Mandalika Girija Shankar at ap_cct@apct.gov.in

(The content on the page is provided by the Exhibitor)