RETURN SCRUTINY AUTOMATION TOOL(RSAT) – Commercial Taxes Department , Andhra pradesh

Revolutionizing GST Scrutiny:Automation for Enhanced Efficiency & Accuracy

Problem

- The manual scrutiny process previously required up to 100 man-hours, leading to inefficiencies.

- Variations in data analysis due to non-standardized processes created inconsistencies.

- Manual processing introduced the risk of errors and bias, affecting the accuracy and fairness of outcomes.

- The absence of standardized reporting reduced transparency and accountability in tax administration.

- Disconnected data sources hindered comprehensive data analysis and decision-making.

Solution

- Introduced a pioneering automation system for GST return scrutiny.

- Identifying key parameters for automation to minimize personal bias in the scrutiny process.

- Ensuring data availability, cleaning, and merging different datasets for credible and actionable intelligence.

- Incorporating dynamic changes in GST laws and rules into the Return Scrutiny Automation Tool for real-time updates.

- The tool generates Return Scrutiny notices in under a minute, significantly reducing the previous processing time of 4 to 5 working days.

Outcomes

- Scrutinized 8,700 cases in the financial year, a significant rise from 2,525 cases the previous year.

- The tool has set a precedent for GST scrutiny automation, influencing GSTN’s nationwide tool development.

- Identified Rs 1,937 Cr in deviations, leading to an additional Rs 293.5 Crores in tax payments.

- Shared with CBIC officials in AP and Uttarakhand, improving efficiency and showcasing effective center-state collaboration.

- Allowed tax authorities to concentrate on major evasion cases, optimizing resource use.

Challenges

- Ensuring compatibility of the new technology with existing tools, systems, and databases posed significant challenges.

- Handling large volumes of data while maintaining accuracy, security, and reliability was difficult.

- Implementing new IT systems required adjustments to workflows and procedures.

- Adequate training and support for end-users, including officers and external stakeholders, were essential for smooth adoption.

- Real-time incorporation of changes in the GST Act and rules into the system was an ongoing challenge.

SKOCH Award Nominee

Category: State Government – Finance

Sub-Category: State Government – Finance

Project: RETURN SCRUTINY AUTOMATION TOOL(RSAT)

Start Date: 4-06-2023

Organisation: Commercial Taxes Department , Andhra pradesh

Respondent: Mandalika Girija Shankar

https://apct.gov.in/GSTPortal/Ap_index.aspx

Level: Premium Plus

Video

See Presentation

Gallery

Case Study

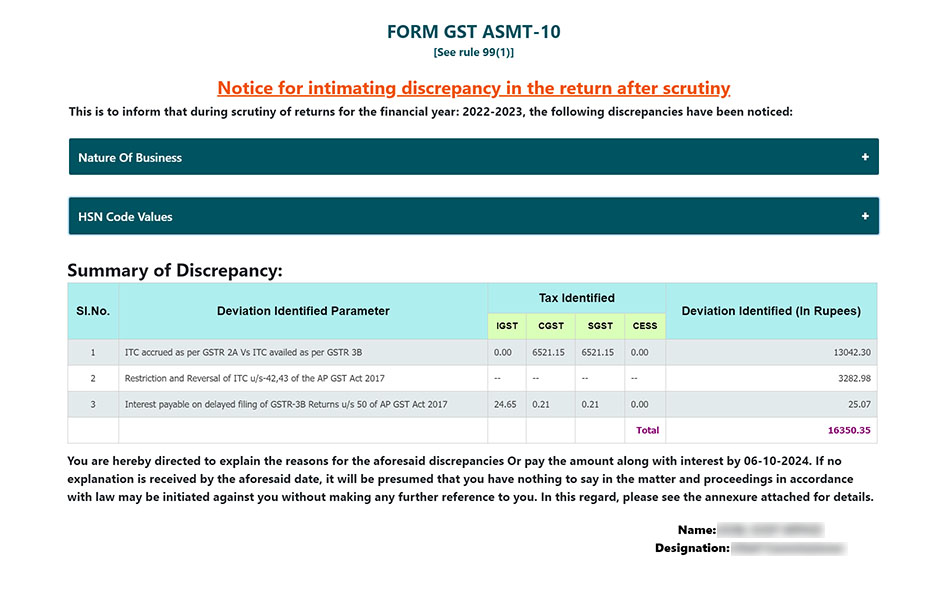

Revolutionizing GST Scrutiny: Automation for Enhanced Efficiency and Accuracy

Problems

The tax administration faced several issues including high manual processing times, inconsistent data analysis, human errors and bias, lack of accountability, and data silos. The manual scrutiny process was time-consuming, inconsistent, and prone to errors, leading to inefficiencies and reduced transparency.

Solutions

To address these challenges, a computer-based automation tool for GST return scrutiny was introduced. Key solutions included automating the scrutiny process to reduce personal bias, integrating and cleaning data from various sources, incorporating real-time updates of GST rules, and significantly speeding up the return scrutiny notice generation from days to minutes.

Outcomes

The implementation of the automation tool led to a substantial increase in scrutiny cases, from 2,525 to 8,700 within a year. It set a precedent in Indian tax administration, receiving recognition from GSTN and CBIC. The tool identified deviations amounting to Rs 1,937 crore, enhancing tax payments by Rs 293.5 crore. It also fostered better cooperation between centre and state officials and allowed tax authorities to focus on significant evasion cases.

Challenges

During implementation, several challenges were encountered. Integrating the new technology with existing systems proved difficult, requiring compatibility with current tools and databases. Managing large volumes of data was challenging, demanding accuracy, security, and reliability. Change management was another hurdle, as new IT systems necessitated updates to existing workflows and procedures.

Innovation

The project introduced a highly innovative automation tool that transforms the return scrutiny process, cutting processing time from days to under a minute. It boosts efficiency by consolidating discrepancies into single reports, allowing for increased case handling with minimal human resources. This automation also supports other enforcement actions and features GST MITHRA, enhancing taxpayer compliance and reducing litigation.

Opportunities

Future opportunities for the scrutiny automation tool include integrating third-party data sources like RERA, Municipal Administration, and IT databases to enhance its effectiveness. Expanding the tool’s capabilities to incorporate additional data will further improve accuracy in identifying discrepancies and strengthen overall tax administration efficiency.

Summary

The project introduced an innovative Return Scrutiny Automation Tool (RSAT) that transformed the manual scrutiny process from a multi-day task into a near-instantaneous operation. By automating the analysis of tax returns, the tool drastically improved efficiency, reduced human errors, and increased transparency in tax administration. It enabled the department to handle a significantly higher volume of cases, detect substantial discrepancies, and enhance resource allocation.

For more information, please contact:

Mandalika Girija Shankar at ap_cct@apct.gov.in

(The content on the page is provided by the Exhibitor)