Leadership – Retail Banking – Bank of India

The best way to show your appreciation for this project is to click some advertisements and keep a count of how many you clicked. You will be asked for the number of advertisements that you clicked before you can vote. The money generated through this supports our social action.

Retail Banking

Problem

- Offline mode of business generation.

- Limited channels of lead sourcing.

- Manual management of leads.

- Minimum exposure on digital marketplaces.

- Manual and complex documentation system.

Solution

- BOI has setup more than 110

- New LMS/LOS for end to end digital Lead management.

- Leads sourcing through various digital channels.

- Presence on various digital marketplaces.

- End to End STP journey for Retail Products.

- Innovative products designed for maximising Retail customer base.

Outcomes

- Retail Portfolio Growth within 2 Years From 68058 Cr to 94718 Cr.

- YOY Growth with 17.40%.

- Retail Market Share Growth- from 2.26 to 2.32.

- 100000 Cr Retail Portfolio target by Sept 2023 by Standalone efforts

- Digital document execution through E-sign and E-stamping.

SKOCH Award Nominee

Category: Public Sector Bank

Sub-Category: Public Sector Bank

Project: Leadership – Retail Banking

Start Date: 2023-07-10

Organisation: Bank of India

Respondent: Mr Pankaj Deshmukh, Chief Manager

https://bankofindia.co.in/

Level: Club Star

Video

See Presentation

Gallery

Case Study

Bank of India-Retail

Introduction

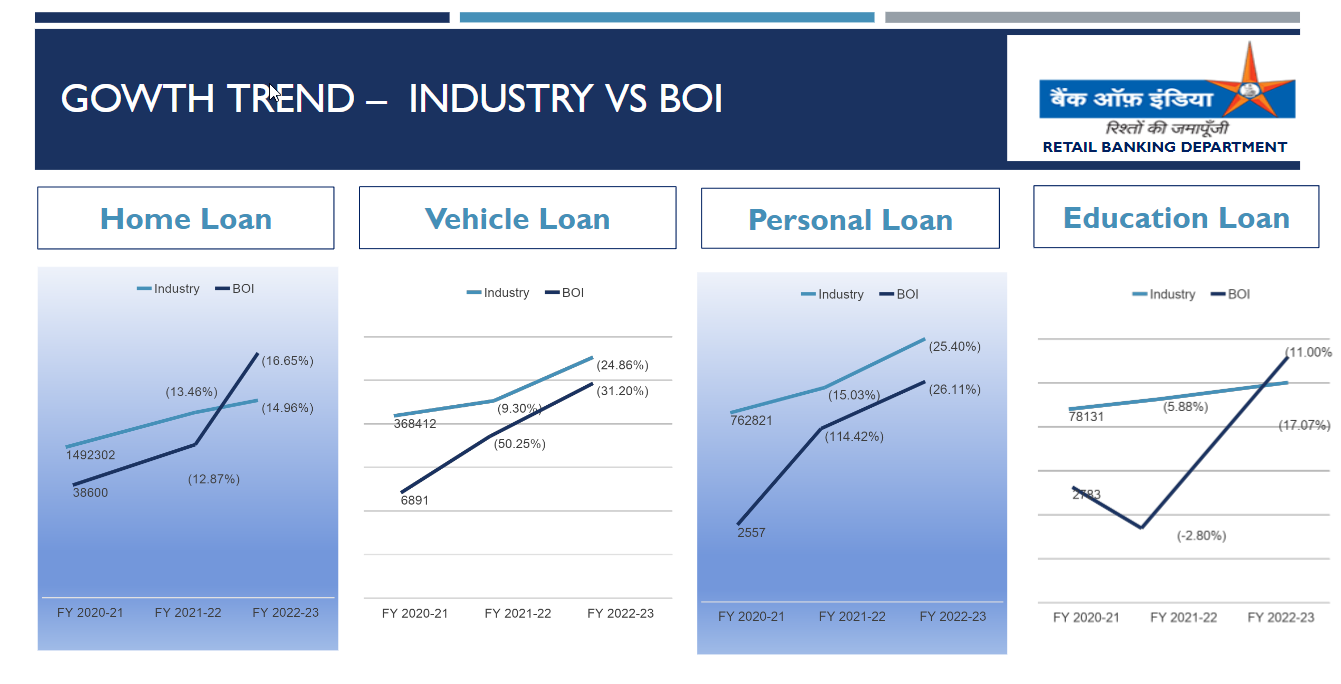

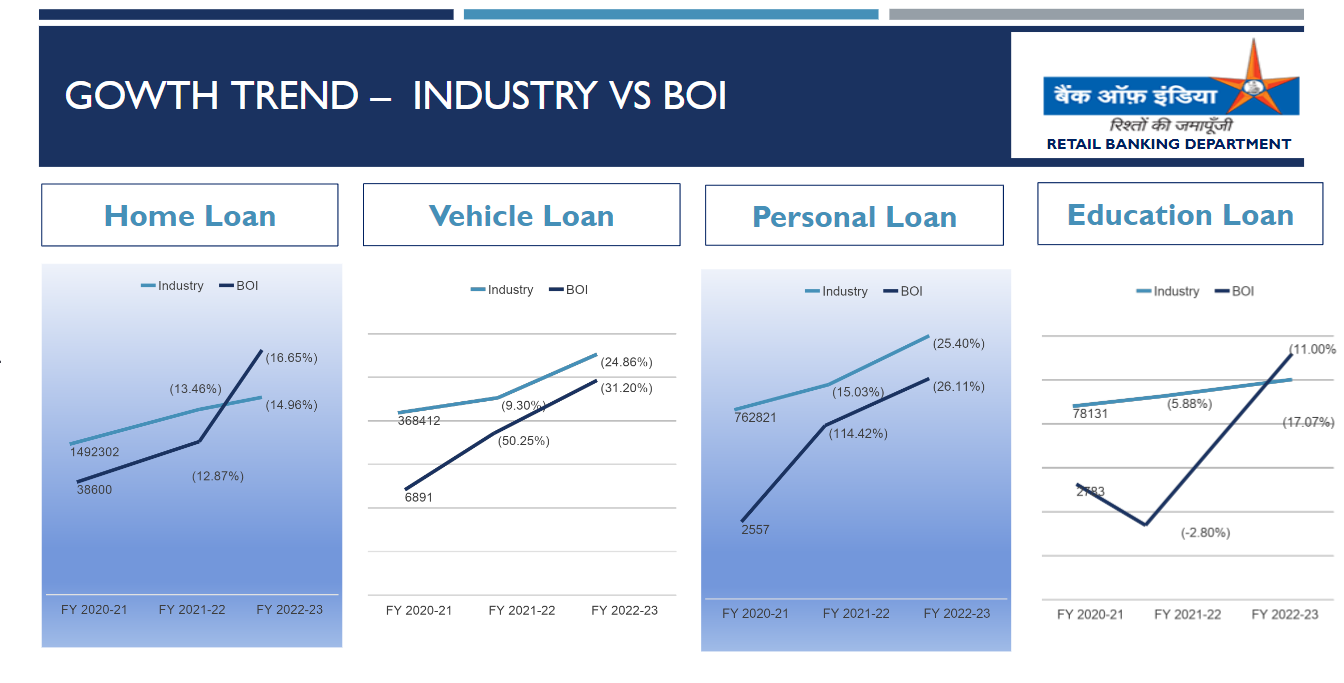

The bank is serving to the retail segment, through its network of all rural, semi-urban and urban branches. The Bank has registered an outstanding level of retail advances of Rs. 94,718 crores thereby registering Y-O-Y growth of 17.41% as on 31.03.2023

Problems

Offline mode of business generation is a problem. Also, limited channels of lead sourcing poses as a significant problems. Again the manual management of leads doesn’t seem to professional.

Solutions

New LMS/LOS is being introduced for end to end digital Lead management. Leads sourcing through various digital channels will increase proficiency. Also, presence on various digital marketplaces is being made sure now.

Outcomes

Retail Portfolio Growth increased within 2 years From 68058 Cr to 94718 Cr. YOY Growth with 17.40% and Retail Market Share Growth- from 2.26 to 2.32.

Challenges

Minimum exposure on digital marketplaces and manual and complex documentation system are two of the major challenges.

Innovation

New LMS/LOS for end to end digital Lead management is an innovative aspect of this project. Also, leads sourcing through various digital channels and presence on various digital marketplaces are innovations of this project.

Opportunities

The projected YOY Growth for the next three years are 17.54%(2023-24), 17.12% (2024-25), 15.38% (2025-26) respectively.

Summary

Market penetration has been achieved through various collaborations and tie-ups, which enabled us to sanction 2.88 lakh accounts amounting to Rs 30,799 crores across all segments of vertical viz. Home Loan, Vehicle Loan, Education Loan etc.

For more information, please contact:

Mr Pankaj Deshmukh, Chief Manager at headoffice.publicity@bankofindia.co.in

(The content on the page is provided by the Exhibitor)

The best way to show your appreciation for this project is to click some advertisements and keep a count of how many you clicked. You will be asked for the number of advertisements that you clicked before you can vote. The money generated through this supports our social action.